3 Reasons Steel Prices Skyrocketed in 2020

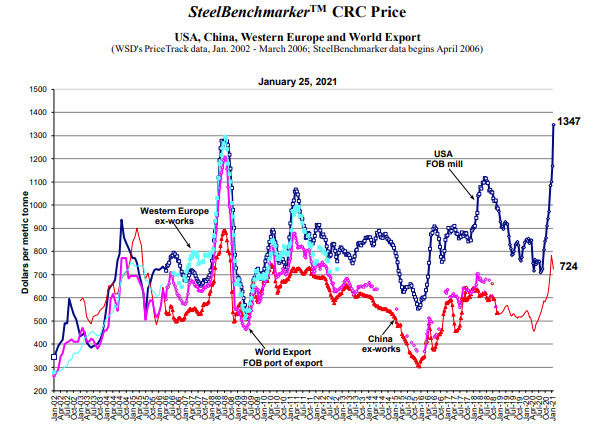

Raw material prices for steel have increased about 60% from the pre-pandemic low in 2020. Prices in the US are forecasted to continue their upward trajectory through at least the first quarter of 2021, but are expected to soften by mid-year. So what exactly happened?

- Many businesses faced unplanned shutdowns due to the COVID-19 pandemic, and steel mills were quick to idle furnaces and curtail production instead of risking uncertainty

- A resurgence in demand in the last months of 2020 while supply and inventory was low drove a rapid escalation in prices, which were further complicated by a raw material scrap shortage

- Steel mills have aggressively raised prices to take advantage of the shortage, with benchmarks like cold rolled steel coil up 100% in 90 days

Additional capacity is expected to come onto the market in 2021 that will ultimately provide relief, but it’s uncertain when this might happen and how much prices may continue to climb before then. Many of the factors that started driving steel prices higher in 2020 are still at play as we enter 2021, and demand for steel is forecasted to grow by 6.7% in North America this year as the economy rebounds. Whether prices start to level out in Q2 or H2 of 2021 appears to be largely dictated by the mills, their utilization rates, and what profit margins they want to make while they’re holding all the chips.

What drove steel prices higher in 2020? Steel production capacity was significantly reduced through 2020 as already slowing demand nearly stopped due to uncertainty in the global economy, and many factories were forced to pause operations during the global Covid-19 health pandemic. Mills that were able to stay open and operating focused on their larger contract orders, pushing price increases and lead times for smaller customers and leading to a shortage in scrap.

Many feel that mills have been more aggressive than needed with prices increases and are taking advantage of this supply shortage to pad their margins while demand is strong. Mills are continuing to hold on aggressive pricing in 2021 and only offering discounts on large volumes. Lourenco Goncalves, President and CEO of Cleveland-Cliffs, said this of his philosophy regarding mill production: “I have said time and time again that I am for value, not for volume.” Make hay while the sun shines, as they say.

But the pandemic wasn’t the only thing in 2020 affecting steel. Transportation costs increased as steel competes for domestic trucking capacity with many other industries that were seeing a surge in demand including lumber products and ATVs. The price of nickel has also been soaring under tight supply and increasing demand. Though typically under 20% of the composition of stainless steel, nickel may soon be three times the price of chromium per ton making it the largest cost component in many cases. Section 232 Tariff on imported nickel is causing uncertainty on decisions to buy foreign nickel with a 3 – 5 month lead time. Canadian steelmaker Stelco suffered an operations-impacting cyber attack. Pittsburgh-based Allegheny Technologies Incorporated, previously one of the big three, announced they would exit the stainless steel sheet market by mid-2021, opting to shed it in favor of optimizing operations for higher margin business. And in the last quarter of 2020, we saw signs of life as demand starts to pick back up. So now we have supply shortages and excess demand where we before had excess capacity and declining demand.

It appears as though we’ll face some other headwinds into 2021 as well. The Biden administration has highlighted many priorities for the year, and this does not appear to include swift reversal of tariffs or import restrictions. The Covid-19 pandemic continues to impact supply chains around the world. Even China, which has recovered more quickly than much of the world has had to implement new lockdown measures after a wave of cases in the Hebei region, which contributes over 20% to the country’s output of steel. Deliveries by truck have been suspended leaving only rail for transportation, and mills are hesitant to tie up cash during a soft lockdown leading to delays and shortages. Furthermore, demand for nickel isn’t expected to decrease anytime soon, as it’s an important component in nearly every type of electric vehicle battery. Global demand for nickel specifically for use in EV batteries is expected to grow from 60,000 metric tons in 2018 to some 665,000 tons (an 11x increase) in 2025.

It’s difficult to say exactly when the supply chain will catch up and prices will level off, but according to the American Iron and Steel Institute we should be able to meet demand with current capability. In the week ending on January 16, 2021, domestic raw steel production was 1,738,000 net tons, representing a capability utilization rate of 76.7 percent. That’s still quite a bit lower than the 82.4 percent capability utilization rate for the same week in 2020. Only once the vaccine is fully rolled out in the US and factories are back to operating at pre-pandemic levels will we see the end result of the myriad of factors driving this steep increase in steel.